Bilfinger significantly increases orders received and revenue – cash flow improved – outlook confirmed for full year 2023

- Markets: Continued positive demand for efficiency and sustainability solutions in all regions and industries

- Orders received €1,385 million: +26 percent organic growth, with positive factors including major orders and inflation

- Revenue €1,053 million: +12 percent organic growth partly benefiting from a mild winter

- EBITA €22 million: Increase from €9 million in prior year, which included €10 million in negative special items

- EBITA margin 2.1 percent: Increase from 0.9 percent in prior-year period

- Outlook for 2023 confirmed: Revenue €4.3 billion to €4.6 billion, EBITA margin 3.8 percent to 4.1 percent

- Capital Markets Day: Presented strategy being systematically implemented; new mid-term targets communicated

- Efficiency program: On track

Industrial services provider Bilfinger is making tangible progress with its further developed strategy toward sustainability as well as with its efficiency program. Orders received and revenue increased significantly in the first quarter of financial year 2023. EBITA and the EBITA margin were higher than in the prior-year period. Free cash flow improved significantly compared to the prior year.

Orders received of €1,385 million (2022: €1,117 million) were positively impacted by factors including major new orders, inflation-related price adjustments and higher revenue expectations from framework agreements. The increase in revenue to €1,053 million (2022: €961 million) was driven by all segments and was partly benefitting from a mild winter. EBITA was €22 million (2022: €9 million), with the low prior-year figure including €10 million in negative special items related to the discontinuation of operations in Russia.

“Our solutions to improve efficiency and sustainability for our customers continue to be well received. This cuts across all customer segments and regions,” said CEO Thomas Schulz. “Our goal is to be No. 1 in this market.”

The strategy presented at the Capital Markets Day is being implemented through a series of targeted measures. It has two directions of thrust: repositioning Bilfinger as a leader in enhancing efficiency and sustainability as well as operational excellence to boost Bilfinger’s performance. Among other measures, the US business is being repositioned towards more service offerings to reduce the impact of the volatile project business. The efficiency program launched in November 2022 is another of the strategy’s key elements. Its aim is to standardize workflows and streamline administrative structures in order to reduce costs. In addition, the efficiency program is directed at upskilling the workforce by establishing and expanding training centers, providing standardized and certified training courses as well as systematically increasing training and employee development. The necessary measures are currently being defined and discussed with labor representatives.

Alongside the renewal of existing framework and service contracts, Bilfinger also secured new contracts in the first quarter for improving the efficiency of industrial plants. For instance, the Kuwait Ministry of Electricity, Water and Renewable Energy commissioned Bilfinger to supply and install replacement parts for filter membranes in a reverse osmosis project at the Shuwaikh Power Generation and Water Distillation Plant. In Germany and Austria, Bilfinger will drive forward the heat energy transition for various municipal utilities. Here, the company is providing a wide range of engineering services relating to pipework for heat pumps as well as supplying and installing ultra-efficient two-zone heat exchangers. For a carbon capture project in Norway, Bilfinger is providing piping and insulation for Aker Carbon Capture at a Heidelberg Materials cement plant. Carbon capture, utilization and storage (CCUS) is one of the key technologies for achieving carbon neutrality in industry. Capturing CO2 emissions as they occur and utilizing or storing them significantly reduces the volume of environmentally harmful greenhouse gas emissions from industry.

Group development in Q1 2023

Orders received by the Bilfinger Group in Q1 2023 increased by 24 percent (organically 26 percent) to €1,385 million (prior year: €1,117 million). Positive factors included major new orders, inflation-related price adjustments and higher revenue expectations from framework agreements. The order backlog grew by 12 percent (organically 14 percent) to €3,491 million (prior year: €3,130 million). The book-to-bill ratio of 1.31 is particularly high due to the first-quarter seasonal effect of lower revenue at the beginning of the year.

Group revenue grew by 10 percent (organically 12 percent) to €1,053 million (prior year: €961 million) and was partly benefitting from a mild winter. Gross profit went up by 6 percent to €100 million (prior year: €95 million). The gross margin as a percentage of revenue amounted to 9.5 percent (prior year: 9.9 percent). This was lower than in the prior year due to the repositioning of the US business in the Engineering & Maintenance International segment. Selling, general and administrative expenses increased by 5 percent – less than revenue – to €78 million (prior year: €75 million). As a result, SG&A expenses as a percentage of revenue decreased to 7.4 percent (prior year: 7.7 percent).

Bilfinger increased EBITA in the first quarter to €22 million (prior year: €9 million), corresponding to an EBITA margin of 2.1 percent (prior year: 0.9 percent; excluding special items 2.0 percent). The prior-year figure included €10 million in negative special items for the discontinuation of operations in Russia. Net profit improved to €7 million (prior year: -€6 million). Return on capital employed (ROCE) after taxes reached 3.8 percent (prior year: 0.3 percent).

Despite the significantly higher revenue, the seasonally negative free cash flow improved to -€26 million (prior year: -€76 million) due to a smaller increase in working capital. Capital expenditures on PP&E were €12 million (prior year: €9 million). Net liquidity including lease liabilities decreased as expected to €79 million at the end of the first quarter (beginning of the year: €145 million).

Engineering & Maintenance Europe segment

Orders received in the Engineering & Maintenance Europe segment increased by 25 percent (organically 29 percent) to €922 million (prior year: €736 million). This reflects major new orders, inflation-related price adjustments and higher revenue expectations from framework agreements. In addition, a number of contracts were won for the installation of heat pumps and heat storage systems. Revenue went up by 8 percent (organically 10 percent) to €683 million (prior year: €635 million). The book-to-bill ratio was 1.35. EBITA increased to €25 million in the reporting quarter (prior year: €13 million), corresponding to an EBITA margin of 3.6 percent (prior year: 2.0 percent). It should be noted that the prior-year period in this segment included the €10 million in negative special items. On a purely operational basis, the EBITA margin improved slightly from 3.5 percent to 3.6 percent.

Engineering & Maintenance International segment

In the Engineering & Maintenance International segment, orders received rose by 48 percent (organically 42 percent) to €241 million from a relatively low base in the prior year (€163 million). Revenue grew by 8 percent (organically 3 percent) to €171 million (prior year: €159 million). The book-to-bill ratio thus stood at 1.41. EBITA was negative at ‑€6 million (prior year: ‑€1 million), and the corresponding EBITA margin was ‑3.3 percent (prior year: ‑0.5 percent). The negative EBITA is mainly due to legacy contracts in one of the segment’s US entities of a kind that will no longer be offered in future years. Structural adjustments are currently initiated in response. It is an integral part of Bilfinger’s strategy to reduce risk in the project business and the share of projects in total revenue. This will be reflected primarily in the Engineering & Maintenance International segment, where it will make a significant contribution to improving earnings.

Technologies segment

Orders received in the Technologies segment increased by 11 percent (organically 12 percent) to €193 million (prior year: €173 million). Starting from a low base in the prior year, revenue grew 43 percent (organically 44 percent) to €178 million (prior year: €124 million), reflecting the good level of orders for biopharma projects received in the prior year. The book-to-bill ratio was 1.08. Segment EBITA increased in the first quarter to €5 million (prior year: €0 million); the EBITA margin reached 3.0 percent (prior year: 0.1 percent).

Outlook for 2023

Based on the first-quarter business performance, the outlook for the current financial year is confirmed:

For 2023, Bilfinger expects revenue of between €4,300 million and €4,600 million (2022: €4,312 million). The Group’s profitability will increase, with an EBITA margin of 3.8 percent to 4.1 percent (2022: 1.8 percent; excluding special items: 3.2 percent). This increase will stem from operational improvements and the initial positive effects of the efficiency program. EBITA is not expected to be impacted by any further special items.

Following strong growth in the prior year, revenue in the Engineering & Maintenance Europe segment will be between €2,750 million and €2,950 million (2022: €2,785 million). Bilfinger anticipates an EBITA margin in this segment of 5.0 percent to 5.4 percent (2022: 3.8 percent; excluding special items: 5.0 percent).

Likewise following a significant increase in the prior year, revenue in the Engineering & Maintenance International segment is expected to total €720 million to €820 million (2022: €798 million). The EBITA margin here will be between 1.0 percent and 3.0 percent (2022: -1.0 percent; excluding special items: -0.7 percent). This means that, despite the loss in the first quarter, this segment will contribute positively to earnings in 2023.

In the Technologies segment, the expectation is for revenue of €600 million to €700 million (2022: €592 million) as well as an improvement in the EBITA margin to between 4.0 percent and 5.0 percent (2022: 1.4 percent; excluding special items: 3.0 percent).

Free cash flow is forecast to be between €50 million and €80 million (2022: €136 million), as there will be cash outflows of around €60 million in 2023 to implement the efficiency program and capital expenditures will return to a normal level of around 1.5 percent of revenue.

Key figures for the Group

| in € million | ||||

| Q1 | FY | |||

| 2023 | 2022 | ∆ in % | 2022 | |

| Orders received | 1,385 | 1,117 | 24 (org: 26) | 4,615 |

| Order backlog | 3,491 | 3,130 | 12 (org: 14) | 3,226 |

| Revenue | 1,053 | 961 | 10 (org: 12) | 4,312 |

| Gross margin (in %) | 9.5 | 9.9 | 10.1 | |

| EBITDA | 46 | 32 | 41 | 174 |

| EBITA | 22 | 9 | 148 | 75 |

| thereof special items | 0 | -10 | - | -65 |

| EBITA margin (in %) | 2.1 | 0.9 | 1.8 | |

| Net profit | 7 | -6 | - | 28 |

| Earnings per share (in €) | 0.18 | -0.16 | - | 0.71 |

| Operating cash flow | -15 | -67 | 132 | 166 |

| Free cash flow | -26 | -76 | - | 136 |

| thereof special items | -4 | -6 | - | -20 |

| Net CAPEX | 12 | 9 | 23 | 52 |

| Employees (number at reporting date) | 29,514 | 30,349 | -3 | 30,309 |

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/9/csm_MGCN_1_d66e998939.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/2023-BW_Underground-Energy-storage-Zuidwending_0623.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/One_Global_Website/References/20240507_Header_Reference_DSM.png)

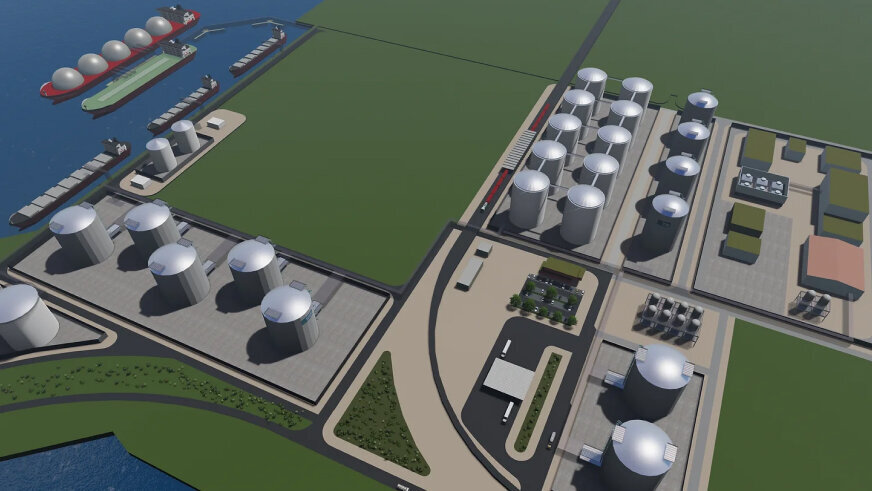

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/Holland_Hydrogen_1_Birdseye_view-New_Render.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/20141113_122453.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/Greenergy_3.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/IMG_9151_ABZ_Diervoeding_2016__2_.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/csm_Aspen_f2c40f8d72.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/iStock-629111916.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/TheNetherlands/Bilfinger_in_the_Netherlands/References/csm_Synthon_6e69827257.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/Germany/Ueber_Uns/Bilfinger_in_Deutschland/Bilfinger_Life_Science/Referenzen/WebRef_F_1.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/Germany/Ueber_Uns/Bilfinger_in_Deutschland/Bilfinger_Life_Science/Referenzen/WebRef_SKW_24_01_rgb_8_A5_GMP-Anlage_SKW.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/Germany/Ueber_Uns/Bilfinger_in_Deutschland/Bilfinger_Life_Science/Referenzen/WebRef_IMG_5414.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/Germany/Ueber_Uns/Bilfinger_in_Deutschland/Bilfinger_Life_Science/Referenzen/WebRef_Pharma_08_01.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/Germany/Ueber_Uns/Bilfinger_in_Deutschland/Bilfinger_Life_Science/Referenzen/WebRef_Rentschler_25_5_16_1219_bearbeitet2.jpg)