Successful strategy sets Bilfinger on course for sustainable profitable growth and higher capital efficiency – Mid-term targets confirmed – 2024 outlook updated to include acquired Stork units

- Market situation: Stable to positive across all regions and industries, increased demand for outsourcing due to volatile environment

- Business model: Solutions for enhancing customers’ efficiency and sustainability benefit from both growing and declining markets

- Strategy: Successful implementation with sustainable profitable growth; progress made in all strategic levers

- Successful integration of Stork: Margin potential opened up by complementary business supports achievement of mid-term targets; further acquisitions planned

- Cash flow optimization: Improved efficiency in Net Trade Assets, with a new mid-term target of <8 percent (in relation to revenue)

- Mid-term targets 2025/2027: Confirmed,growth of 4 to 5 percent p.a., EBITA margin of 6 to 7 percent and cash conversion of more than 80 percent, investment grade rating and increased total shareholder return remain in focus

- Group outlook for 2024: Including successful Stork acquisition with revenue €4.8–5.2 billion, EBITA margin 4.8–5.2 percent, free cash flow €100–140 million

Frankfurt. At its Capital Markets Day 2024, Bilfinger presented key elements of its successful strategy implementation, its cash flow optimization and its updated outlook for 2024 including Stork. The industrial services provider helps customers reach their profitability targets through its comprehensive range of solutions for enhancing efficiency and sustainability. Bilfinger takes care of the planning, construction, maintenance, modernization and automation of industrial and energy production plants, thereby enhancing plant efficiency and enabling customers to focus on their core business. Here, the Bilfinger business model benefits from both growing and declining markets. The company is continuing its sustainable profitable growth across all regions and industries, putting it on track to reaching its mid-term targets up to 2025/2027 and beyond.

Following the acquisition of parts of the Stork business, Bilfinger has raised its revenue outlook for 2024 to €4.8–5.2 billion, slightly increased the expected EBITA margin range to 4.8–5.2 percent and confirmed the free cash flow forecast of €100–140 million.

In the Engineering & Maintenance Europe segment, into which the acquired units are currently being integrated, revenue of €3.2–3.6 billion and an EBITA margin of 5.7–6.1 percent are expected for 2024. These figures include around €15 million in restructuring and integration costs, which are, however, offset by a positive earnings effect (badwill) of approximately the same amount arising on initial consolidation.

“We are successfully implementing our strategy and are set to achieve our mid-term targets on schedule. This opens up significant potential for supporting our sustainable profitable growth. Our organic growth is being systematically augmented through acquisitions, as demonstrated by Stork. This will lead to a considerable increase in total shareholder return. I would like to thank all of our employees for their unrelenting efforts to achieve our goals,” said Bilfinger Group CEO Thomas Schulz at the Capital Markets Day in Frankfurt.

Industrial trends lend tailwind to Bilfinger’s business model

“Our customers are facing major challenges in a volatile global environment characterized by geopolitical conflicts, inflation, skilled labor shortages, excessive bureaucracy and increasing sustainability requirements. These trends are pushing up demand for greater energy efficiency, outsourcing, reduced complexity, modernization through digitalization and skilled professionals. Bilfinger’s offering is a perfect match for this demand.” Thomas Schulz explains: “We have set ourselves the target of being the No. 1 choice for our customers when it comes to enhancing efficiency and sustainability. Customers who commission Bilfinger will see greater efficiency which goes hand in hand with improved sustainability. This benefits our customers, our investors and our team alike.”

Strategic levers for achieving mid-term targets

The company continues to successfully implement its strategy to achieve its mid-term targets. Following completion of the efficiency program last year, Bilfinger is now concentrating on two strategic levers:

The focus of the first strategic lever is internal: Bilfinger is continuously enhancing its own operational excellence for the benefit of its customers.

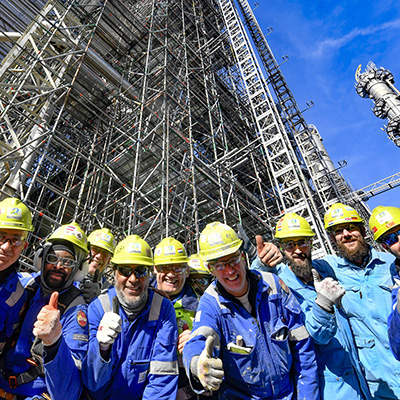

Training and education are among the cornerstones of this approach. To this end, Bilfinger education GmbH was successfully established as a pilot model in October 2023. The aim is to increase the company’s attractiveness to both employees and customers through targeted training, knowledge transfer and professional development as well as to further raise safety standards and generate higher revenue going forward with highly skilled employees.

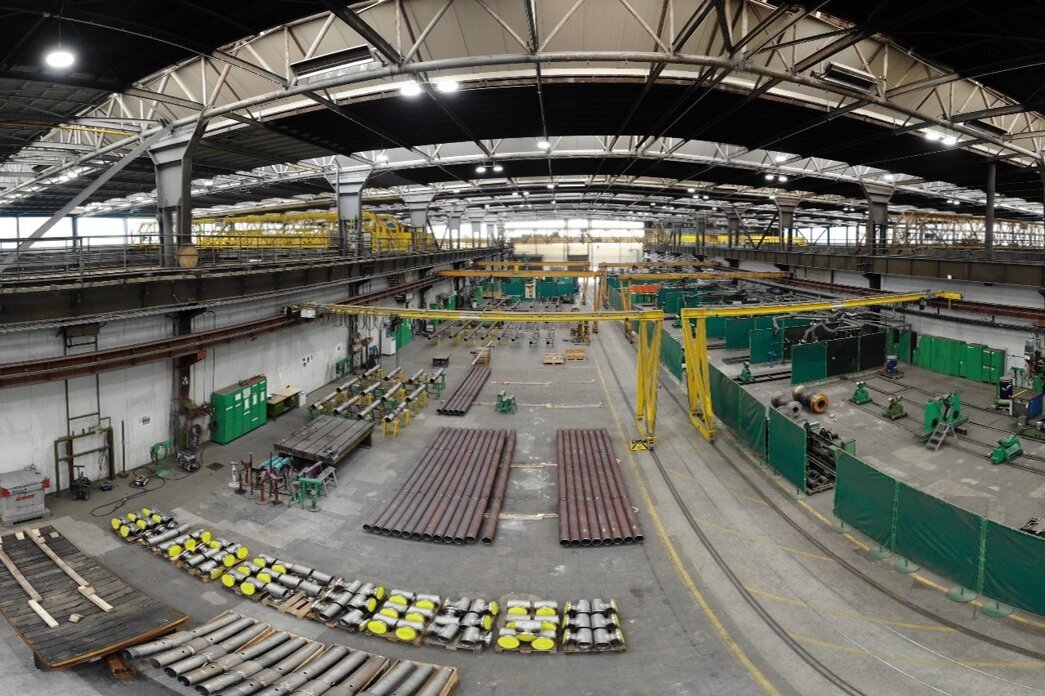

The focus of the second strategic lever is external: Bilfinger is positioning itself as a solution partner for its customers. Through its comprehensive industrial services portfolio, Bilfinger supports its customers in increasing their efficiency and sustainability. By bundling services from a single source, the efficiency and sustainability effects for customers are considerably enhanced.

The aim is to offer all Bilfinger products in existing markets and serve all prospective customers. This expansion of the service portfolio is reinforced by higher demand for outsourcing and opens up significant potential for Bilfinger’s sustainable profitable growth. It will also be achieved through additional acquisitions.

Bilfinger is leveraging further efficiency and growth potential in the area of automation, digitalization and artificial intelligence. In so doing, the company is bolstering the transformation of industry toward more digital solutions. The share of revenue attributable to supportive digital solutions will increase to more than 40 percent in the mid-term. Process automation, predictive maintenance as well as the use of drones and robotics are just a few examples. This not only strengthens Bilfinger’s market competitiveness but at the same time enhances efficiency for customers.

Sustainability is a core element of Bilfinger’s corporate strategy. This is likewise reflected in the achievement of the company’s own sustainability targets on the path to net zero across the entire Bilfinger value chain. Additionally, over the mid-term, Bilfinger intends to generate its revenue exclusively in business areas that make a positive ecological contribution.

Stork acquisition: integration underway

The integration of Stork began immediately after the transaction closed on April 1, 2024. This is testimony to the caliber of the business acquired as well as the customer base and workforce. It is a transaction encompassing operating units in the Netherlands and Belgium as well as in Germany, with more than 2,700 skilled employees and annual revenue of around €530 million. The complementary portfolio generates synergies in the offering to customers and in administration. This will enable Bilfinger to swiftly tap into the earnings potential.

One example of synergies created in the customer offering is HyCC, a provider for the large-scale production of green hydrogen in the Netherlands. Following the acquisition, reactive plant maintenance and plant modification as well as strategic maintenance planning and asset management can now be offered from a single source at all customer locations. Another example is Shell’s 200 MW hydrogen plant, which uses offshore wind power to supply the Pernis refinery near Rotterdam with green hydrogen. Bilfinger is expanding its range of services here to include electrical and mechanical work in addition to technical consulting, insulation, scaffolding and corrosion protection.

The successful Stork acquisition represents a blueprint for Bilfinger’s acquisition strategy: Bilfinger intends to primarily grow in markets where the company is already active, with products that are already available. At the Capital Markets Day, the Group CEO listed the Middle East, North America and parts of Europe as potential target regions.

Capital efficiency increased

Following implementation of the functional organization, the company is now ready to sharpen its focus on targeted aspects of capital efficiency and cash generation. Group CFO Matti Jäkel said: “Cash flow is an indicator of a healthy business, so we are assessing and optimizing the entire process from the preparation of customer quotations to receipt of payment by the company.”

In addition to the mid-term target of achieving a cash conversion ratio of more than 80 percent as already communicated, the company has set a new target net trade assets to revenue ratio of under 8 percent in order to increase capital efficiency. As with the other mid-term targets, this is to be achieved in the period 2025 to 2027.

Means of increasing net trade assets efficiency include the improvement and automation of billing processes, supplier management and dunning systems. De-risking applied in the negotiation, acceptance and execution of contracts will also have a positive impact.

Strategy implementation leads to sustainable profitable growth

The growth, profitability and cash flow trends at Bilfinger are testament to the effectiveness of its strategic levers. Bilfinger’s targeted M&A strategy will pave the way for additional growth and higher margins.

Bilfinger has confirmed its mid-term targets up to 2025–2027, including average organic revenue growth of 4 to 5 percent per year, an EBITA margin of 6 to 7 percent and a cash conversion rate of at least 80 percent. The company will continue to focus on returning to an investment grade credit rating and increasing the total shareholder return.

![[Translate to English:]](/fileadmin/_processed_/f/2/csm_Andreas_Hilpert2_ddc1f2fbe5.jpg)

![[Translate to English:]](/fileadmin/_processed_/f/c/csm_400x400_Ulrich_Trebbe_V2_Website_ab0e20129e.png)