Sustainability

at Bilfinger

Sustainability is a key component of our corporate strategy. With our services, we make a significant contribution to helping our customers achieve their sustainability goals. We enhance efficiency, reduce emissions and increase the performance of plants in the process industry.

We have firmly anchored the concept of sustainability in our corporate structures. It is defined as a goal in our Mission Statement and is an integral part of our Code of Conduct as well as relevant internal Group Policies. We have been reporting on our sustainability activities on an annual basis since 2011 and have published an externally audited non-financial Group declaration every year since 2018. Bilfinger is a member of the UN Global Compact initiative, supports the UN Sustainable Development Goals and issues an annual declaration of conformity with the German Sustainability Code.

In the area of sustainability, Bilfinger is evaluated by several external institutions. We are in regular, active contact with MSCI-ESG, ISS-ESG, Sustainalytics, CDP and Ecovadis, among others.

Bilfinger acts as a strategic partner for the process industry, delivering comprehensive services and decades of experience to help our customers achieve their sustainability goals. We are determined to become no. 1 when it comes to increasing efficiency and sustainability for our customers."

The Executive Board is responsible for sustainability. Sustainability management at Group level is coordinated and aligned with the SustaiNet sustainability network, which is coordinated by Group Treasury & Investor Relations under the responsibility of Executive Board member Matti Jäkel (Group Chief Financial Officer).

SustaiNet members include the heads of the three segments Engineering & Maintenance Europe, Engineering & Maintenance International and Technologies as well as the heads of selected Group functions and units whose areas of responsibility have points of contact with sustainability issues.

SustaiNet meets at least twice a year as scheduled; in addition, meetings are convened on an ad-hoc and project-related basis. In addition to the formal exchange in the sustainability network, the members as well as employees in their functional areas are in regular contact on individual sustainability topics.

We have been carrying out regular materiality analyses for many years with the goal of determining the key areas of action for sustainability at our company. The most recent fundamental analysis was conducted in 2020 and was updated in subsequent years. In 2023, we carried out a new, regularly scheduled comprehensive materiality analysis.

A comprehensive list of sustainability topics that could potentially be relevant for Bilfinger (longlist) was drawn up in anticipation of the Corporate Sustainability Reporting Directive (CSRD), a set of regulations that will apply from the 2024 financial year. We initially included all topics, sub-topics and sub-sub-topics specified in the European Sustainability Reporting Standards (ESRS E1-G1) in the longlist. The future, standardized catalog of sustainability reporting topics was thus fully taken into account. We also included additional company-specific topics that were considered material for Bilfinger in our previous reporting.

We then reduced this broad collection of topics to a list of sustainability topics that are specific to Bilfinger (shortlist) by excluding areas that are obviously immaterial.

The subsequent validation was carried out taking into account the perspectives of the stakeholder groups important to Bilfinger. An internal SustaiNet stakeholder panel assessed the materiality of each individual shortlist topic using a standardized scoring model. The assessment for individual stakeholder groups was carried out by the following panel members:,

- Customers: Heads of the three segments Engineering & Maintenance Europe, Engineering & Maintenance International and Technologies as well as the Head of Products & Innovation

- Employees: Head of Human Resources & HSEQ

- Suppliers: Head of Procurement

- Capital market: Head of Treasury & Investor Relations

In the stakeholder panel validation process, both the Group’s own activities and its value chain (upstream / downstream) were considered from a dual materiality perspective. This non-financial Group declaration takes into account issues that have been classified as material in terms of their financial materiality for the company and their impact materiality for the environment and society. At the same time, the results of the analysis also serve as preparation for future reporting in accordance with CSRD regulations. In this regard, topics will be reportable that are considered material either in terms of financial materiality, impact materiality or both categories.

The result of the materiality analysis was finally validated by the Group Executive Management and validated and approved by the Executive Board of Bilfinger SE.

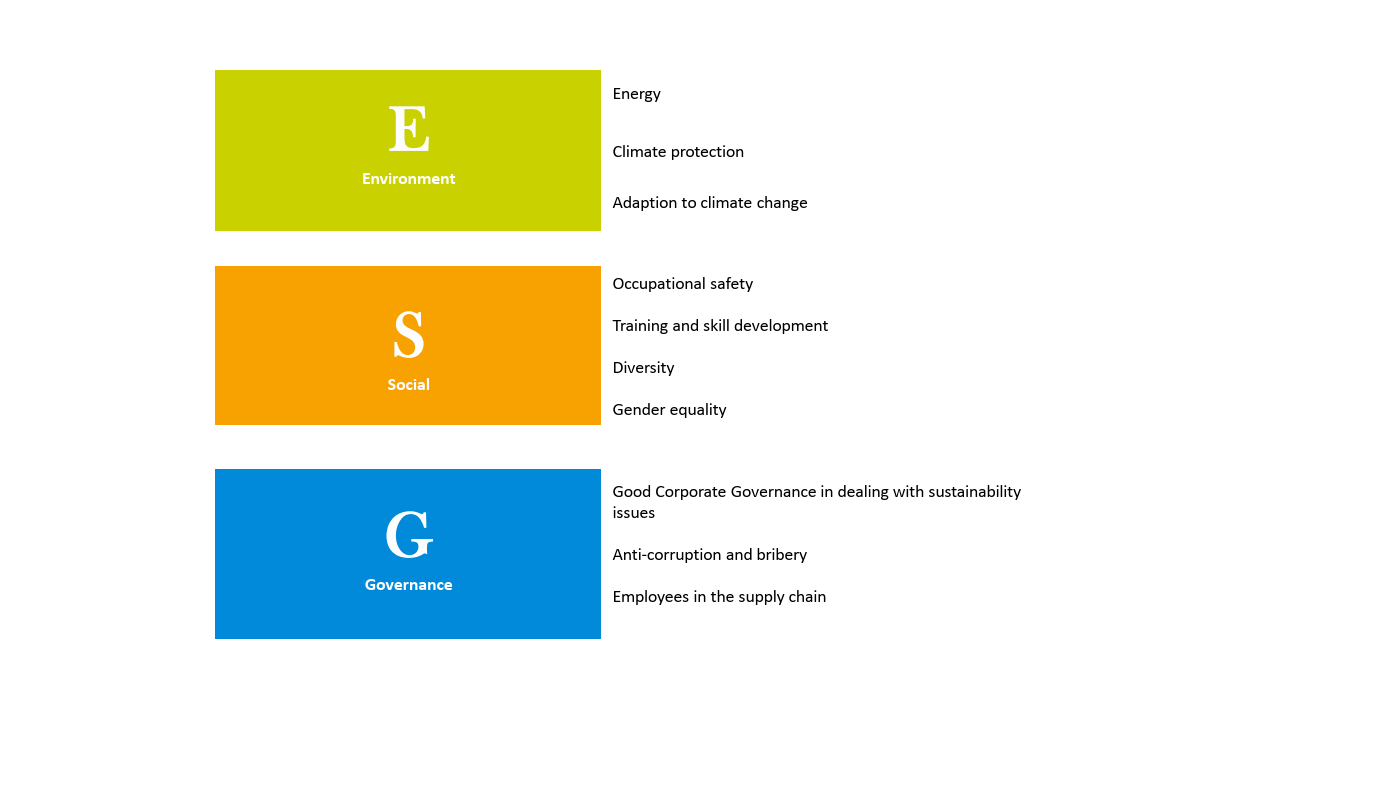

In order to structure the content of the non-financial Group declaration, we have assigned the sustainability issues defined as material in the 2023 analysis to the established Environment, Social and Governance (ESG) categories. We also report on the disclosures in accordance with Article 8 of the EU Taxonomy Regulation.

As a result of the materiality analysis 2023, changes were made compared to the previous year’s non-financial Group declaration.

These relate, on the one hand, to data security, i.e. the protection of internal company data from unauthorized access by third parties. In previous analyses, this aspect was regularly classified as a material sustainability aspect in the governance category. Although this assessment has not changed, the classification of data security as a sustainability topic no longer seems appropriate from today’s perspective. Data security is comprehensively covered by Group risk management as part of the fundamental IT-related risks and is therefore presented here in the opportunities and risks report of the combined management report. There is no redundant explanation in the non-financial Group declaration.

Data protection and quality management were also categorized as material sustainability topics in the governance category in previous analyses. In our view, the allocation of these topics to the area of sustainability is also no longer appropriate from today’s perspective. Their significance in relation to other aspects is no longer above the materiality threshold, meaning that data protection and quality management are no longer reported on in the non-financial Group declaration.

Sustainability is a key component of our corporate strategy. We use an indicator-based approach that creates transparency both internally and externally. Further key figures have been added to the non-financial Group declaration, including the frequency of all work-related accidents and market-based measurements of CO2 emissions in accordance with the GHG Protocol. The content is now clearly divided into the areas of Environment, Social and Governance, significantly improving comparability with other companies."

Sustainability targets of the Bilfinger Group

In 2022, Bilfinger set clear targets in each of the three sustainability categories Environment, Social and Governance. These were pursued further in the reporting year and still remain valid. With our sustainability targets, we support the United Nations Sustainable Development Goals (SDGs) number 4 Quality education, 7 Affordable and clean energy, 8 Decent work and economic growth, and 9 Industry, innovation and infrastructure.

Our Sustainability targets

Leading partner to enhance efficiency and sustainability of customers

Climate neutrality of GHG emissions Scope 1 and 2 by 2030 at the latest

Collect GHG emissions Scope 3 and support Science-based Targets Initiative

Occupational accidents: Zero is possible

Investment of at least 0.5 percent of the Group's revenue annually in the training and further education of employees

Conduct at least 600 internal supplier audits annually

Becoming a leading partner for improving our customers’ efficiency and sustainability

Bilfinger has set itself the target of becoming the leading partner for our customers when it comes to enhancing the efficiency and sustainability of their plants. Increasing awareness of climate change and the ensuing energy transition in many industrialized countries are generating substantial opportunities for Bilfinger to exert influence here. The energy, chemical & petrochemical, oil & gas as well as pharma & biopharma industries are the Bilfinger Group’s largest customer groups. Given the socially and politically mandated energy transition and climate protection measures in all key stages of the value chain, they are all facing fundamental innovative leaps.

Achieve climate neutrality in terms of Scope 1 and 2 GHG emissions by 2030 at the latest

In the course of our daily work, we pay close attention to the careful use of valuable resources and address the urgent task of limiting climate change to the greatest extent possible. The focus in this regard is on efforts to reduce our own energy consumption, gradually substitute the use of fossil fuels with renewable or low-CO2 energy sources and thus sustainably limit burdens on the atmosphere from harmful greenhouse gases.

In financial year 2023, further steps were taken in the segments of the Group to reduce their respective emissions and thus the emissions of the Group as a whole in accordance with the Greenhouse Gas Protocol (GHG) Scopes 1 and 2. A tool for recording and structuring reduction measures has been available to the segments since the beginning of 2024. The combination of various measures for the next few years includes a shift from purchased electricity to renewable sources, gradually replacing the passenger vehicle fleet with electric vehicles as well as installing photovoltaic systems and the implementation of energy efficiency initiatives at our sites.

In terms of GHG Protocol Scope 1 and 2 emissions caused by our operations, we have set a target of being climate neutral by 2030 at the latest. Most importantly, this includes a reduction in emissions. In the case of unavoidable emissions, compensation is also provided through the support of additional CO2-reducing projects combined with the purchase of carbon credits.

Collect data on Scope 3 GHG emissions and support Science Based Targets Initiative

In 2023, we recorded and reported emissions from all categories of the upstream value chain in accordance with GHG Protocol Scope 3 for the first time. Categories of the downstream value chain will follow in 2024.

We made our intention to set ourselves ambitious, science-based targets clear by registering with the Science Based Targets Initiative in April 2023. By April 2025 at the latest, we intend to submit our targeted reduction path for GHG emissions to limit global warming to a maximum of 1.5 degrees Celsius to the SBTi for review.

Avoid all occupational accidents wherever possible

The physical well-being of all our employees is our top priority. For this reason, occupational safety is a crucial factor in all our activities. It is our goal to be a leader in occupational safety in our industrial sector. Our Zero is possible aspiration serves as a guideline for continuously improving occupational safety in all areas and preventing as many occupational accidents as possible.

Invest at least 0.5 percent of Group revenue annually in employee training and development

In order to maintain and further strengthen the Group’s competitiveness, we will make targeted investments of at least 0.5 percent of Group revenue per year in the training and further education of Bilfinger employees in the future. From financial year 2024 onwards, we will allocate a quarter of the savings from the efficiency program implemented by the end of 2023 to this in addition to the previous expenses.

Conduct at least 600 internal supplier audits annually to effectively meet the Group’s due diligence obligations

Our Statement of Principles on Respect for Human Rights together with the Group’s Code of Conduct regulates the human rights-related principles that apply to all Bilfinger employees and suppliers. To effectively meet our due diligence obligations in the Group’s supply chain, we have set the target of conducting at least 600 internal supplier audits per year in accordance with defined standards. With a total of 1,167 audits, the target number was significantly exceeded in the reporting year.

Find the Bilfinger Group´s sustainability indicators at a glance here.

The identification and evaluation of risks that arise from the company’s business operations and that affect the reportable aspects are the responsibility of risk management. The focus is on the question of which risks arise from our business activities and relationships or from our products and services that have an impact on these aspects. Significant risks that are very likely to have or will have serious negative impacts on them must be reported.

Our Group-wide risk management system is described here. Group Accounting, Controlling & Tax is responsible for Bilfinger’s Group-wide risk management system; the Group’s sustainability risks for the 2023 financial year were determined as part of the materiality analysis in collaboration with the Strategy department. For the purposes of identification and assessment, the results with regard to the negative impact of business activities on the environment and society (impact materiality) were used as a basis. The likelihood of occurrence and the potential extent of damage were used to assess the risks. It was subject to the same calibration as in previous years and was conducted as part of the regular meeting of the Bilfinger Risk Committee.

Reportable risks on sustainability issues were not identified.